Tax & Wealth Planning

Department

The Tax & Wealth Planning department within Baloise Vie Luxembourg was created in 2018 and includes of 5 collaborators.

Its main missions are:

- Monitoring local and international tax developments as well as European tax developments through the various directives, with the aim, among other things, of keeping contracts documentation up-to-date and offering tailor-made solutions to each market ;

- Checking at an early stage the acceptance of wealth management offers to Baloise’s clients.

- Assisting clients in the search for and implementation of particular and tailor-made structures, both for Luxembourg company structures (SOPARFI, SPF, FIS, SICAR, securitisation vehicles) and for non-Luxembourg company structures or asset protection vehicles (trusts, foundations,...) in the context of life insurance ;

- Analysing legal and fiscal possibilities for asset transfers ;

- Accompanying clients and responding to all their requests regarding wealth management offers and the personalisation of life insurance contracts on:

- Structuring;

- Estate and tax planning;

- Portability;

- Analysis of non-traditional assets (i.e. private equity);

- Drafting, writing or check of beneficiary clauses;

- Implementing specific structures (e.g. dismembered subscriptions, growth clauses, conventional return, etc.);

- …

In addition, the Tax & Wealth Planning department works closely with the commercial department to ensure the various dossiers follow-up and supports the preparation of commercial events with the sales, assets and marketing teams.

| Contributions |

|---|

|

Case Study: pledging a policy and the leverage effect – Case Study / Chapter 7 Case Study on Luxembourg capitalisation policies in Belgium – Case Study / Chapter 8 Comparison between life insurance policies and capitalisation policies – Comparative / Chapter 8 Case Study Italy : Life insurance and beneficiary trust – Case Study / Chapter 9 Depending on the country of residence, on which parts of the policy should a wealth transfer strategy be based? – Comparative / Chapter 9 Portability of the life insurance contract: what characteristics needs to be adapted when relocating? – Comparative / Chapter 10 |

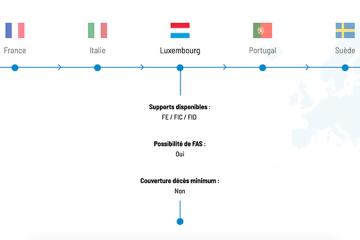

Portability of a policy from France to Portugal

Depending on the country of residence, on which parts of the policy should a wealth transfer strategy be based?

Portability of the life insurance contract: what characteristics needs to be adapted when relocating?

Introducing risk management to wealth planning - new solutions for nordics

Case Study Italy : Life insurance and beneficiary trust