Assignments of debt and pledges

Life insurance and capitalisation contracts have many advantages. In particular, they enable policyholders to this type of policy to provide their creditors (for example, a bank or credit institution) with a guarantee for repayment of a debt or a loan. It is thus possible to use an assignment of debts and a pledge.

What is an assignment of debt?

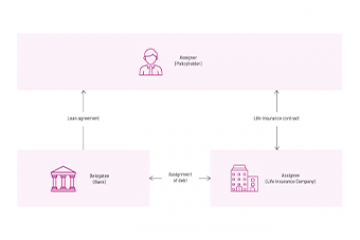

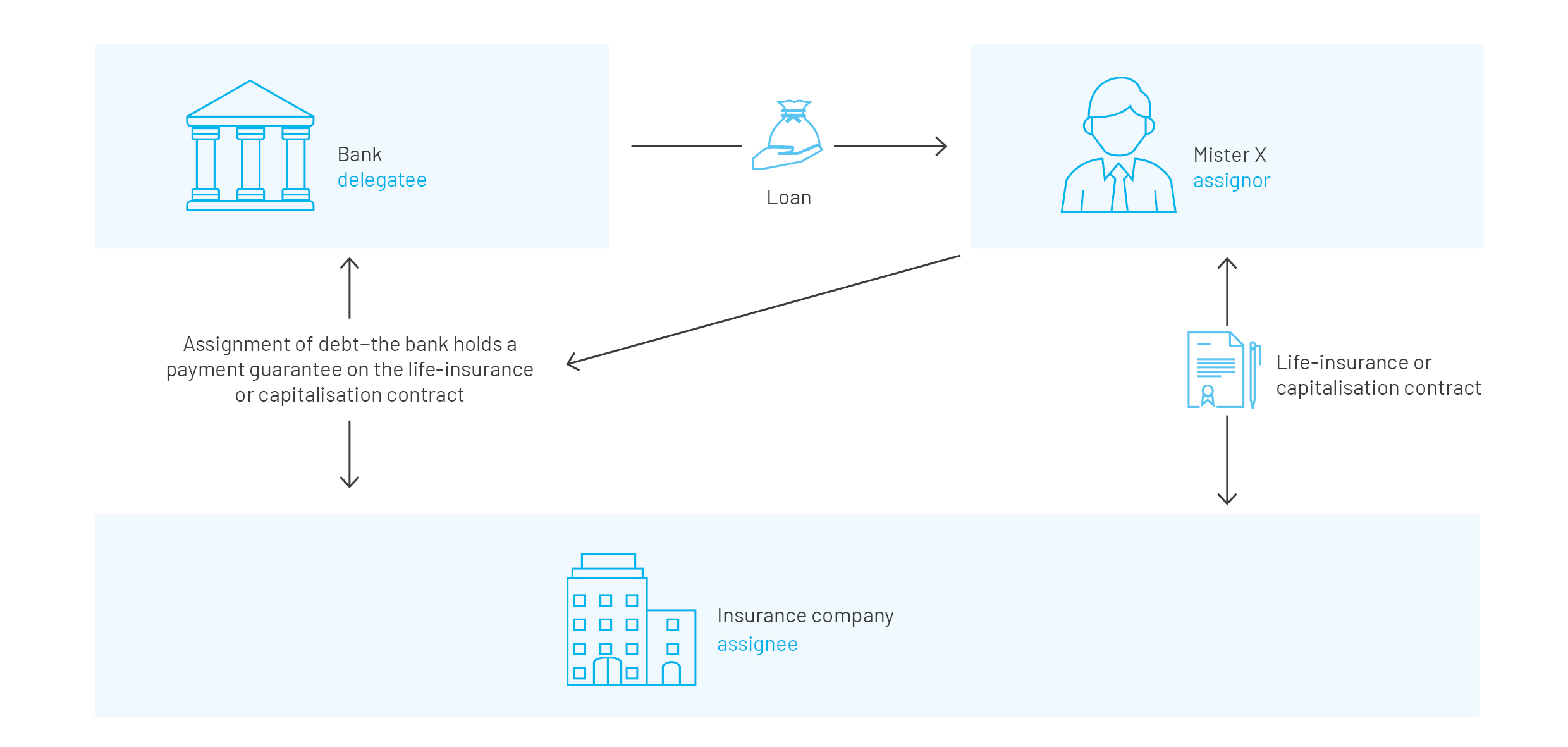

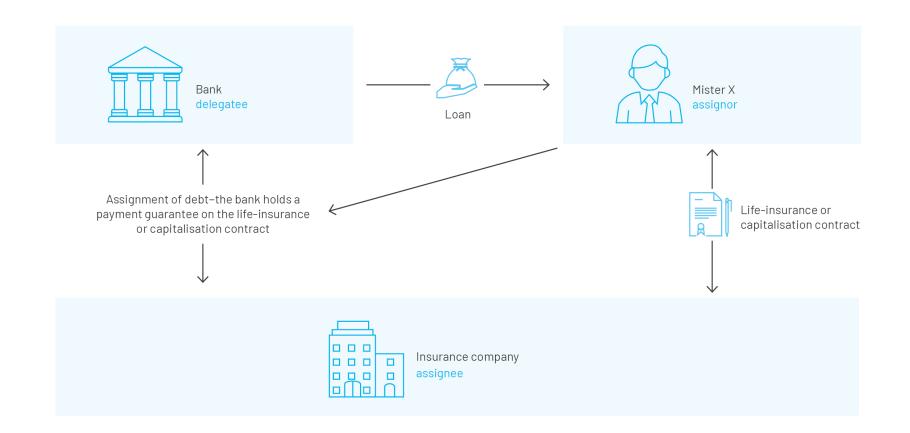

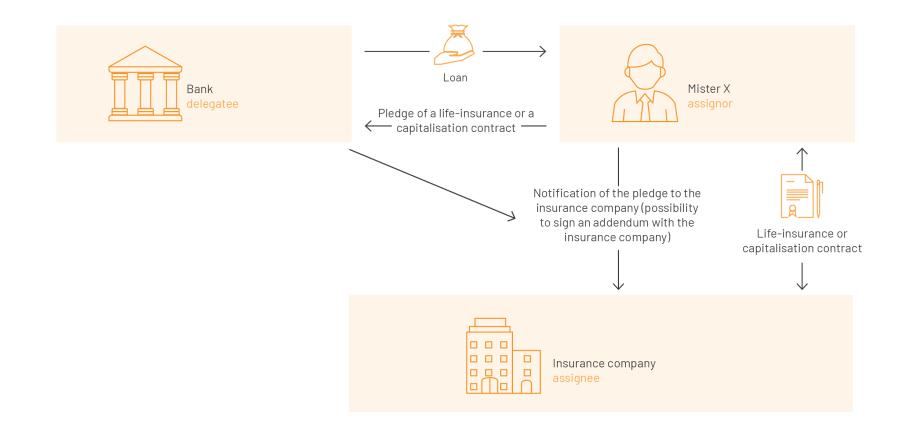

An assignment of debt is defined by the Civil Code as “a transaction by which one person (the ‘assignor’) obtains a debt from another person (the ‘assignee’) who undertakes to repay a third party (the ‘delegatee’) who accepts him as debtor”...

Example: Mr. X's bank has granted him a loan and it wishes to obtain a guarantee for payment of the instalments due under the loan. Mr. X has also taken out a life insurance policy with his insurer. In such a case, an assignment of debt may be made in order to repay the bank (the delegatee) in the event of default in payment by Mr. X (the assignor), in accordance with the terms of the assignment of debt.

An assignment of debt may be:

- ‘Imperfect’ when the assignor (Mr X, the borrower) is a debtor of the delegatee (the bank) but the latter has not released him from his debt, since the assignment gives the delegatee a second debtor (the insurer). The payment made by one of the two debtors releases the other, in due proportion.

- ‘Perfect’ when the assignor (Mr X) is a debtor of the delegatee (the bank) and the wish of the delegatee to discharge the assignor results expressly from the act, the assignment operates by novation.

The vast majority of assignments of debt are imperfect assignments of debt.

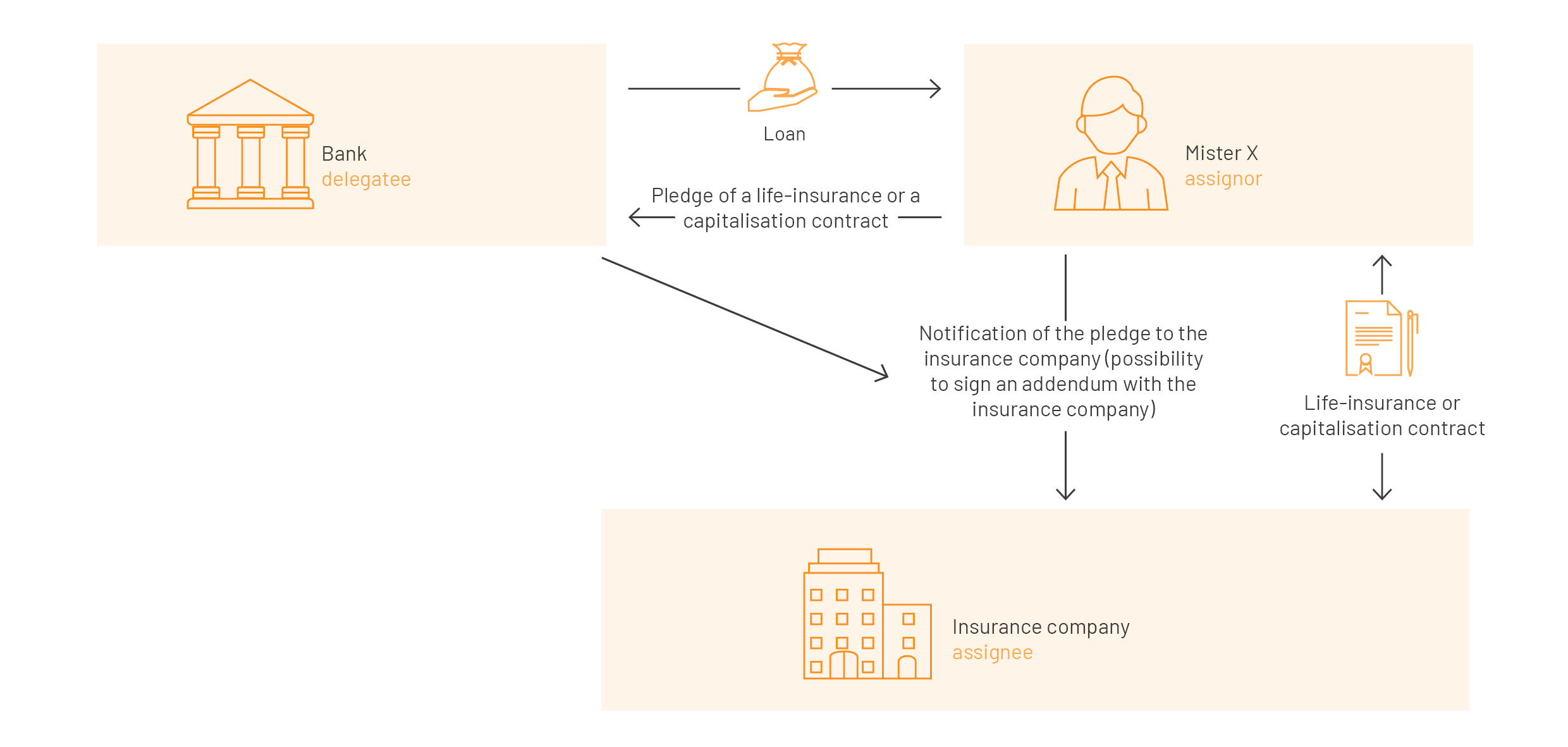

What is a pledge?

A pledge is defined as a transaction by which the policyholder offers his policy as collateral to a creditor so that the latter may be paid (in priority) the amount of the guaranteed claim (and within the limits of the provisions of the policy) out of the insurance payout, in the event that the borrower (debtor) fails to meet his obligations.

What are the common features and differences between an assignment of debt and a pledge?

These two types of collateral share several points in common:

- only the policyholder may pledge his life insurance policy or capitalisation policy;

- assignments of debt and pledges both comprise a number of components which include the reciprocal commitments of the parties, and in particular a description of the pledged or assigned creditor's claim and the specific procedures in the event of a redemption during the term of the assignment. In principle, if the policyholder does not honour his debt, the creditor has the right to demand redemption of the life insurance or capitalisation policy, up to the amount of the policyholder's debt, within the limit of the policy’s value on the day when he makes his redemption request and the terms of the deed;

- when the insured is different from the policyholder, you need to have his consent to the assignment of debt or pledge;

- the spouse’s agreement is also necessary when the policyholder is married under a community regime, and the funds invested in the life insurance or capitalisation policy are jointly owned;

- creation of the assignment of debt or the pledge is subject to the agreement of the designated beneficiary if the latter had accepted the benefit of the said policy before creation of the assignment of debt or of the pledge;

- the policyholder may no longer act freely in the management of his life insurance or capitalisation policy, such as switching or surrender transactions. Indeed, he must request prior authorisation of the secured creditor or delegatee;

- when a life insurance or capitalisation policy is taken out with a Luxembourg insurance company, a warrant for the waiver of professional confidentiality must be granted by the policyholder in order to release the insurance company from the professional confidentiality to which it is bound under Luxembourg law;

- the charge over the life insurance or capitalisation policy is lifted when the policyholder has fully repaid his debt to his creditor and this creditor has informed the insurer of this by means of a release.

However, these two types of collateral differ in several aspects and, particularly, the following:

- a life insurance or capitalisation policy may be pledged either by endorsement or by deed subject to the formalities provided for in Articles 2355 to 2366 of the Civil Code. The insurer's signature is therefore not necessarily required when the pledge is communicated to him;

- conversely, in the case of an assignment of a claim, a clear expression of intent on the part of all parties, i.e. the assignor, the delegatee and the assignee (and other parties depending on the circumstances) is essential.

Thus, an assignment of debt and a pledge have many advantages which are common to both types of collateral. The choice between these two types of collateral, and their content, depend on the intention of the parties and on the applicable laws or regulations.

Assignment of debt and pledge are two techniques that allow you to pledge your life insurance or capitalisation policy in return for a loan. How do these two solutions differ? And what do they have in common?