Pledging a life insurance contract : how and why ?

EXPERT’S VOICE: QUESTIONS TO KARINE VILRET, PARTNER WILDGEN

“What is relevant for the client is that these guarantees are extremely inexpensive to implement with maximum security."

Text version :

Q1. Why using a life insurance contract as a guarantee?

Luxembourg life insurance policies are very flexible and free as regards contractual terms and are easy to pledge as collateral. Normally life insurance policies are used as a pension or savings instrument. The advantage of using them as collateral is that the savings invested in a life insurance policy can be used as a guarantee for a landing bank. In other words, when you have a life insurance policy, you necessarily have a claim, a claim which belongs either to the policyholder or to the beneficiary of the insurance benefits. Such claims, which ultimately are intangible personal property forming part of the policyholder's or the beneficiary’s assets, may be pledged as security. We may “charge” or “pledge” a life insurance policy in the same way as we are accustomed to providing security by means of pledges, guarantees or mortgages. What is interesting for the consumer is that these forms of security are very inexpensive to put in place, with maximum security, so that they are very advantageous for all parties, whether borrowers or banks. For example, in most cases insurers do not charge for assignments or pledges of a life insurance policy: these form part of the ancillary services offered by the insurer. So, when you think about comparing it with a mortgage, it's not quite the same thing.

Q2. What are the different types of guarantee?

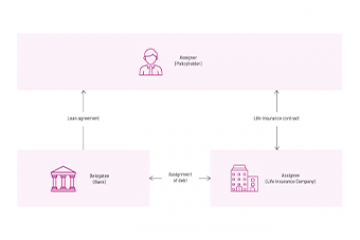

There are several ways to use a policy as security: by pledging or by charging or by assigning it. The difficulty is always in finding the right form of security for a specific case. In some situations, we may prefer the pledge of an insurance policy. Why? Because for legal reasons, which can appear to be somewhat complex, we may need to have an agreement which is supplementary to the initial loan agreement or life insurance policy, just as the pledge is a security interest which is supplementary to the principal obligation and the guarantees.

We also have the procedure of assignment which is derived from the general law of obligations in civil law. Business practice has, for many years, considered that life insurance policies may be used as collateral by assignment. Assignment is an independent commitment which is very reliable because, today, we have no worries about the legal system, which works incredibly well and with greater security for the bank. Why? Because it is an independent commitment of the insurer towards the lending bank, which will become the second debtor, ranking after the first debtor, namely the person who has received the loan. In this situation, it is clear that when we have an insurer as guarantor, we benefit from exceptional market confidence because we know very well that it is extremely unlikely that an insurance company will go bankrupt.

We may also provide for an assignment of rights, namely that when we are the policyholder, we have a life insurance policy with our insurer, and we can assign our rights to either professional or private lenders. In this position, the question arises: what am I transferring? In other words, when you pledge your policy as collateral, what will become of this policy? This, finally, is where the contractual issue takes on its full force; namely, when it is necessary to provide contractually in the deed for an assignment, or pledge or charge, will it become necessary to organise the transfer of these rights contractually. Why? Because the transaction’s security will lie in the very wording of the rights which are to be transferred and in the manner in which they are transferred.

Q3. What are the consequences of a guarantee?

In terms of the rights which are transferred as a result of the pledge, there are many rights which belong to the policyholder which are known as personal rights, such as the rights to surrender or to an advance.

The right to surrender is the right to surrender the policy, in whole or in part. The right to an advance is the right to ask the insurer for an advance, i.e. for sums as an advance on the premiums invested and on the claim which he has against the insurer. A related question is what we call the transfer of the right to switch. What is switching? Switching is the policyholder's right to choose which assets will act as the underlying for his life insurance policy. Thus, it is very important that this choice is formally recorded, because the value of the security is based above all on the assets, and the nature of the assets invested. The bank will treat the loan differently, depending on whether you invest in shares or in bonds. So, we need to be able to control the policyholder’s possible divestment choices.

Another important point concerns the nomination of the beneficiary of the insurance policy. It is important to know whether or not you have nominated a beneficiary in your insurance policy. From the moment when you offer it as security, and if the beneficiary does not accept this, the beneficiary's right to benefit under the policy is revoked. So, this continues to have a fundamental impact on the policyholder's rights. If the benefit of the policy is accepted inadvertently, then it would indeed have priority over the beneficiary clause initially decided upon. It is very important, in practice, to review all the terms and conditions in the beneficiary clause.

Are there any other consequences? One other consequence is that the savings are certainly tied up for so long as the loan is guaranteed or until it is repaid. The difficulty is always to match the termination of the loan and the termination of the life insurance policy. There are some quite simple provisions which can be included in policies and which regulate the different contractual terminations. There is no problem where the loan agreement expires before the insurance policy. However, if the insurance policy expires before the loan agreement, there must be an adjustment - and possibly a renewal - of the policy and/or some other type of security must be offered.

Q4. Are there any specifics for Luxembourg?

In the Grand Duchy of Luxembourg, we are geographically very close to our national borders. Out of necessity, we very often have to use the law of our neighbouring countries. A difficulty arises when there is a foreign component in a contractual relationship, i.e. when I have, for example, a policyholder who is French, an insurer which is a Luxembourg company, and a bank which is French. In such cases, the question arises as to the law applicable when the policy is used as security. It is important to understand that although the life insurance sector is highly regulated by Solvency, distribution, etc., and by all the PRIIPS (Packaged Retail and Insurance-based Investment Products) and KID (Key Information Documents) regulations, at the European Union level there are no provisions for the use of policies as security. Since guarantees are not regulated by directives or regulations, we must rely on private international law under which we will have to work on the basis of foundations which we know from international relations.

Q5. What are the key elements to consider?

The advantage of assignments over pledges is that the each of the former is always a new independent commitment and this gives greater security when dealing with credit risk. Also, assignment means that it is not possible to raise objections to non-payment.

There are many issues we may have to discuss in terms of creating guarantees. Is the original obligation still in force? Am I not able to raise objections to this or that fact, or to this or that legal event, such as bankruptcy? It is important to know that if the policyholder is bankrupt, an assignment will still be effective, whereas in the case of a pledge, the latter will terminate in the event of bankruptcy of the policyholder. Thus, the lending bank can rely on greater security. The insurer itself may also prefer a pledge. Why? Because this keeps more to the original contractual relationship, and does not constitute an additional commitment.

Using your life insurance policy as collateral for a policyholder can be very interesting, as it is a low-cost operation that offers maximum security to guarantee a debt with a lending institution. There are several methods of pledging as collateral: pledge, collateral, delegation of debt, assignment of rights. When a life insurance policy is pledged as collateral, the savings are immobilised for the time of the pledge and the subscriber can no longer freely carry out transactions on his contract.