Parties to the Life Insurance Policy

The parties in the insurance contract

What are the main features of Insurance Distribution Directive (IDD) and how does it work?

What is PRIIPs Regulation?

Interview: life insurance contract and italian fiduciary

Distribution of life insurance policies within and outside the EU: insight

PRIIPs KID: turning a good idea into a good outcome

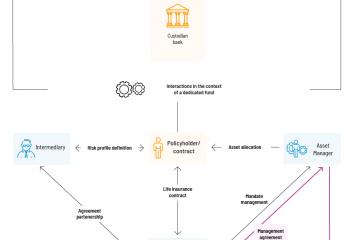

The key players of the ecosystem that makes the Luxembourg life insurance contract so attractive.

Parties to the Life Insurance Policy

A Luxembourg life insurance policy is surrounded by key players essential to each contract concluded: the supervisory authority, the custodian bank(s), the asset manager(s) and the intermediary(s) that makes the contract very attractive.

Supervisory Authority

The supervisory and regulatory body responsible for the insurance sector in Luxembourg is the Commissariat Aux Assurances (CAA). The CAA is a public institution under ministerial authority that ensures the insurance sector functions as intended.

Custodian Bank

The custodian bank is a specialised financial institution that holds money on behalf of others. The custodian bank is a key component of the “tripartite agreement”, signed between the life insurance company, the custodian bank and the CAA.

Asset Management

Asset managers are the ones who take care of financial objectives of the policyholders and perform the day-to-day functions related to the underlying investments.

Intermediaries

Insurance intermediaries serve as a critical link between the insurance companies and the policyholders. They facilitate the placement and purchase of insurance policies and provide their services throughout the lifetime of the insurance contract.

The financial ecosystem in which Luxembourg’s life insurance sector functions is supported by the interconnection between the parties of the contract. It gives policyholders noteworthy benefits : protection and tailor-made solutions for wealth management and asset planning.

Regulatory constraints

In recent years, various regulations and directives of the European legislator has have a major impact on the life insurance sector, particularly on unit-linked life insurance policies: MiFID 2, PRIIPs, IDD and GDPR.

All these regulatory requirements, although a source of constraints for the life insurance sector in Europe, have been put in place with the primary aim of protecting the policyholder.

If you would like to understand the role of the parties in the insurance contract, their interactions and the constraints imposed on them, do not hesitate to download the white paper above.

Luxembourg has created a genuine, high-performance ecosystem around the Luxembourg life insurance contract. Insurance companies, insurance intermediaries, asset managers, custodian banks and the supervisory authority all play a specific role that makes the contract an attractive tool for wealth management.