Distribution of life insurance policies within and outside the EU: insight

|

Marketing from Luxembourg within the European Union |

Marketing from Luxembourg outside the European Union |

|

|---|---|---|

| Does the Freedom to Provide Services (FPS) apply? |

Yes: The FPS system applies throughout the European Union and the European Economic Area. Active FPS will enable any insurer from a Member State of the European Union to market policies within the territorial limits of the European Union, while Passive FPS will give every European Union citizen the right to choose his insurer from within the European Union. |

No: FPS does not apply outside the European Union and, in such cases, insurance subscribers are advised to comply with the laws of each individual country regarding the marketing of policies by foreign insurers in the country concerned. |

| Marketing of life insurance policies |

Every Luxembourg insurer with an authorisation issued by the Commissariat Aux Assurances - and therefore, with a European Passport - may market its policies in another Member State of the European Union without having an office established in that country. |

Some countries allow unapproved foreign insurers to market policies within their borders, but only if the sale results from marketing directly to the client, without a broker or a local sales representative. |

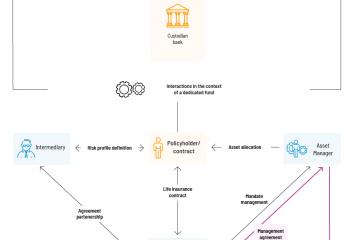

| The prudential law of Luxembourg | The contract will be subject to Luxembourg’s prudential law and the subscriber therefore benefits from: - Increased protection for his assets, thanks to the “Triangle of Security" mechanism and the “special privilege”; - Asset allocation which is subject to Luxembourg legislation and to Circular 15/3 of the Commissariat Aux Assurances and which enables a high degree of investment flexibility. |

The contract will be subject to Luxembourg’s prudential law and the subscriber therefore benefits from: - Increased protection for his assets, thanks to the “Triangle of Security" mechanism and the “special privilege” - Asset allocation is subject to Luxembourg legislation and to Circular 15/3 of the Commissariat Aux Assurances, which enables a high degree of investment flexibility. |

| Portability | Policies marketed under FPS will be “portable” within the European Union when the subscriber moves to another EU country after subscription. The applicable tax regime will be the one of the subscriber's new country of residence. |

A policy subscribed by a person when he is resident outside the European Union may be maintained when he returns to live within the European Union. For example, a person resident outside the European Union decides to set a date by taking out a policy because a return to the European Union is envisaged in the short/medium term. |

| Constraints | Insurance companies must comply with each country’s mandatory rules (e.g. in certain cases the FPS marketing of policies within the European Union may require that the policy be written in the language of the country concerned. |

The rules for marketing by a foreign insurance company in a country outside the European Union may be very restrictive. As a result, in certain cases and where this is authorised, the insurance company will either have to be authorised in the country of each of the policyholders or to establish a branch office there, while complying with the mandatory rules of each of these countries. Furthermore, in certain cases the marketing of policies within the European Union may require that the policy be written in the language of the country concerned. |

It is possible to offer Luxembourg unit-linked life insurance policies outside the European Union. In this case, the distribution is no longer subject to the Freedom to Provide Services Directive. The laws applicable in the country of destination, on the rules for the distribution of life insurance contracts by a foreign insurer, must be observed.