Pledge, assignment of debts, assignment of rights: the guarantees on a life insurance contract

Assignments of debt and pledges

Pledges on life insurance policies: a game worth betting on

What roles do the accepting beneficiary and the irrevocable beneficiary have when there is a guarantee on the policy?

How works the pledging a life insurance contract in the context of operations on the contract

Pledging a life insurance contract : how and why ?

Pledges of insurance policies

What are the different types of guarantees on a life insurance contract?

The life insurance contract can provide creditors with a guarantee for the payment of a debt or credit. Therefore, the policyholder and the creditor, e.g. the lending bank, may pledge the life insurance contract as a security.

From pledge to assignment of debt : the different guarantees on a contract

There are different types of guarantees. Their definitions, specificities and consequences depend on the laws and regulations applicable to each national market. The most common are:

-

Collateral and pledge of a life insurance contract

Collateral of a life insurance contract

When there’s a collateral on a life insurance contract, the policyholder gives his life insurance policy as a guarantee to a creditor. In exchange he obtains a claim (within the limits of the provisions of the contract).

It ensures the creditor is paid in priority if the borrower/debtor's fails to meet his obligations.

Pledge of a life insurance contract

Pledging a life insurance contract refers to the policyholder handing it over to a creditor, as security for a debt.

-

Assignment of debt of a life insurance contract

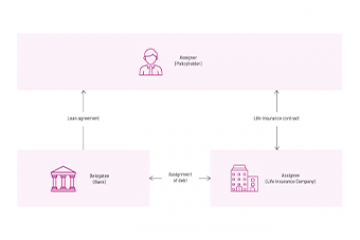

The assignment of debt involves three parties. A person, the assignee, undertakes, at the request of another person, the assignor, to a third person, called the delegatee, who accepts it as a debtor.

-

Assignment of rights under Luxembourg law

The rights resulting from the insurance policy may be assigned in whole or in part by the policyholder.

The nomination of a beneficiary as a guarantee

The nomination of a beneficiary as a guarantee is a mechanism whereby the policyholder of the life insurance policy nominates the credit institution which grants him a loan as the first-ranking beneficiary for the due amounts. The credit institution then accepts the benefit from the policy so to be considered as the accepting beneficiary and thus secure the designation.

The consequences of a pledge on a life insurance contract

When there’s a guarantee on a contract, the policyholder can no longer freely manage his contract by requesting a switch or a surrender. He must first request the authorisation to the creditor (banking institution).

Pledge, assignment of debt : the life insurance contract as a credit instrument as a major planning tool.

The various mechanisms that make it possible to use the contract as a guarantee its role as a major asset planning tool.

The life insurance contract can be used as a guarantee for the payment of a debt or credit. There are various techniques for using a life insurance contract as collateral, each with their own specific features: collateral, pledge, assignment of rights, assignment of debts. Nomination of a beneficiary can also be used.