The protection of assets

The Sapin II Law: consumer protection or confiscation of savings ?

Comparison of different policyholder protection mechanisms in Europe

Asset protection and estate planning

Measurement of the solvency of an insurance company

How the "special privilege" has been improved thanks to the Excell Life case.

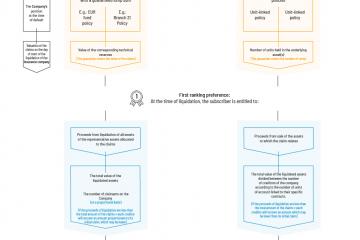

Operation of the special privilege in the event of default by the insurance company

Luxembourg's creditor protection system or "triangle of security": one of the great advantages of the life insurance contract.

The Luxembourg Triangle of Security

The Luxembourg asset protection system is based on two pillars:

- the grant of an absolute privilege to insurance creditors;

- the segregation of assets.

The term "Triangle of Security" refers to the tripartite relationship between the Insurance Company, the custodian bank and the Commissariat aux Assurances, materialised by a custody agreement.

Role and obligations of each party

The Insurance Company receives the premiums from its policyholders of which it then becomes the owner, with the policyholders holding in exchange a receivable from the insurance company. This receivable from policyholders triggers the implementation of the asset protection system. The Insurance Company has an obligation to:

- set up technical reserves on the liabilities side of its balance sheet to guarantee the commitments made by the policyholders;

- establish a permanent inventory of the representative assets in order to create a separate fund of assets;

- demonstrate that it has a sufficient solvency margin.

The Commissariat aux Assurances has a supervisory and control role. In the event of default, it can block the company's accounts with the custodian bank.

The role of the custodian bank is to hold the assets representing the commitments of insurance companies.

Protection further strengthened by the Law of 10 August 2018

When the Insurance Distribution Directive was being transposed, Luxembourg took this opportunity to further strengthen the regime for the protection of insurance claims by clarifying the procedures for applying the Triangle of Security and by individualising protection at the level of the policyholder.

This is how the Triangle of Security contributes to Luxembourg's reputation as a financial centre, particularly for the marketing of life insurance policies.

The protection system for the policyholder of a Luxembourg life insurance policy is commonly known as the triangle of security. The protection of the policyholder is ensured by the triangle of security which designates the tripartite relationship between the insurance company, the custodian bank and the Commissariat aux Assurances. In addition, insurance creditors are granted a super privilege.