Comparison of different policyholder protection mechanisms in Europe

|

|

Luxembourg |

France |

Belgium |

Portugal |

Italy |

|---|---|---|---|---|---|

|

Absolute |

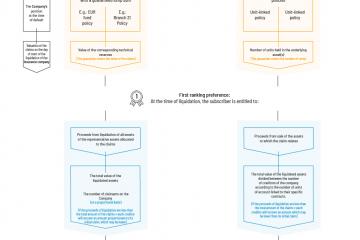

Policyholders = first rank “super-creditors" (in priority over the State, the social security institutions and the employees) in respect of the representative assets for insurance claims. |

|

Insured persons and beneficiaries have a preferential claim on the investments underlying assets. If the insurer enters bankruptcy, they will be able to claim the value of these assets ahead of all other creditors (including the tax authorities and social security institutions). |

All amounts due to a policyholder, an insured or a beneficiary are considered to be an insurance credit. This definition is critical because insurance claims have absolute preference over all other claims against the insurance company. Insurance claims also have priority over the other corporate assets required to compensate for the amount due to them, and cannot be seized. |

|

|

Special |

|

Policyholders = creditors Unsecured second rank creditors (after the State, the social security institutions and the employees). |

|

|

Policyholders have a preferential claim on the net asset value of the assets representing the life and non-life technical reserves. |

|

Segregation |

The assets are deposited with an independent custodian bank and held off-balance sheet by the insurance company. |

The assets are part of the insurance company's balance sheet. |

The assets are part of the insurance company's balance sheet, but the management is separate. |

The Insurance Company's ability to pay investors is ensured by the reserves (sums set aside to cover possible future costs) which the Insurance Supervisory Authority (ISA/ASF) requires the Companies to set up. It is the Company's solvency margin and its assets which, in the end, guarantee payment or non-payment of insurance claims. |

Not in principle, separate management of the underlying assets of certain life insurance policies may be organised.

|

|

Particular |

The "Triangle of Security" mechanism: assets are deposited with a custodian bank approved by the CAA and under the CAA’s overall supervision. |

Reserve fund (Fonds de garantie des assurances de personnes) created in 1999. Payment of an indemnity of €70,000 per policyholder, whatever the number of policies entered into with the same insurance company. In addition to the proceeds from liquidation of the assets by the defaulting company’s liquidator, if the proceeds of liquidation received are not sufficient to ensure payment of the policyholder's entire claim. |

Branch 21 (guaranteed return): Guarantee Fund – payment of compensation, within a period of three months, extendible three times by the Guarantee Fund, up to a maximum amount of €100,000 per person and per establishment. Branch 23 (without guaranteed return): the policyholder and the beneficiary enjoy a legal preference over the representative securities (premiums paid + any capital gain) comparable with a legal preference in Luxembourg. |

The investor compensation scheme guarantees cover of the sums due to the respective investors, with a maximum limit of €25,000 whatever the number of accounts held by the investor and the number of beneficiaries of these accounts. However, neither lump sum nor unit-linked insurance is covered by this compensation system, which means that in the event of the bankruptcy or fraud of an insurer with its head office in Portugal, the investor protection mechanism is very limited. |

Risks relating to existing insurance policies are covered for a period of 60 days from the start of bankruptcy of an insurance company. Policyholders may exercise their right of withdrawal within this period. |

Depending on the country in which a life insurance policy is subscribed, the policyholder doesn't benefit from the same level of protection for his assets. In Luxembourg we find the security triangle and the super-privilege. In France, there is a reserve fund, as in Belgium and Portugal.