PRIIPs KID: turning a good idea into a good outcome

With a self-explanatory title, the purpose of this article is to construct on the Why, What and How of the PRIIPs regulation, in order to understand whether at the end the aforementioned was a good idea, it can deliver as intended (or, should this not be possible, dig deep into the roots).

In order to do so, let's go back to the origins, undertake a reality check followed by the identified challenges and at the end look at the current consultation that will lead to a review, but one that will not be the last (not only because this is a work in progress, but also because the outcomes of the consumer-testing exercise will not be available until mid-2020).

Q1/. Why?

There were two set of objectives and ambitions embedded in the project, one of individual nature, the other more general. Indeed, the development of the KID was seen as a means to allow comparison of similar products and as a tool to enhance the understanding of such products and their embedded features, by the potential clients of a saving product. On top of that, it aim was to enhance the practical development of the EU Single Market, an ambition of particular relevance to a market like Luxembourg’s.

Q2/. What?

The KID has been conceived as a (short) summary document to be shared with the client before the contract is concluded, not aiming to replace but to complement, existing relevant (and detailed) information, both contractual and pre-contractual.

Q3/. How?

Building on the assumption that “too much information kills the information”, but also that some information is a “must have”, the purpose was to create a consumer friendly, three page document. To do so, different tests were undertaken and the agreed methodology introduced, inter alia, scenarios to project performance, but also elements of behavioral economics (e.g. the scoring for the risk level, currently in different shades of grey, was originally designed with the colors of a traffic light, then changed as it was made clear that such an approach would trigger a consumer bias leading to the identification of green with no risk).

Whilst all of the prior make full sense, it is well known that “the proof of the pudding is in the eating”. We had good ingredients to start with, but the two years of application (or temporary exemption) show that, in reality, the KID remains too complicated for many of its end users to understand. On top of that, inter alia, because UCITS is allowed to use the pre-existing KII, full comparability has not been achieved, e.g. when it comes to disclosure of costs. Furthermore, if we consider exogenous changes such as social change and the (massive) use of devices such as smartphones, can we regulate in a way that not only does not embrace this reality but in some cases simply ignores it?

Challenges remain, from the scope and its breadth (as some products seem to simply not fit, so what can we do about them?), to the provision of useful information regarding performance, and the scenarios around it. Allow me to dive in past performance where, contrary to many, I think that, regardless of disclaimers, the use of past performance will lead to unrealistic expectations of returns, in particular within a world of negative rates (behavioral biases again). Other challenges are less obvious, yet must be addressed, including the need or not to change the Level 1 text in order to be able to achieve intended objectives… well, if this is the case, let's not shy away and do it!

The ongoing consultation should become an opportunity for all stakeholders to work together, with the WHY (comparability, comprehension, single market) as a shared goal. We will get more information next November at the hearing that The European Insurance and Occupational Pensions Authority (EIOPA) will host… and maybe a follow up article to reflect on what is shared and discussed.

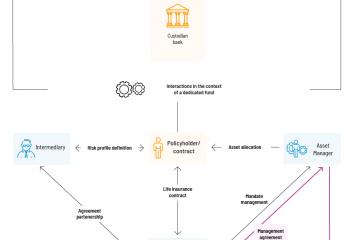

The KID (Key Information Document) has been set up to provide clear information to life insurance policyholders and to enable them to compare different types of products with each other. It is a summary document on the life insurance contract (its costs, its operation) which must be given to the policyholder before subscription.