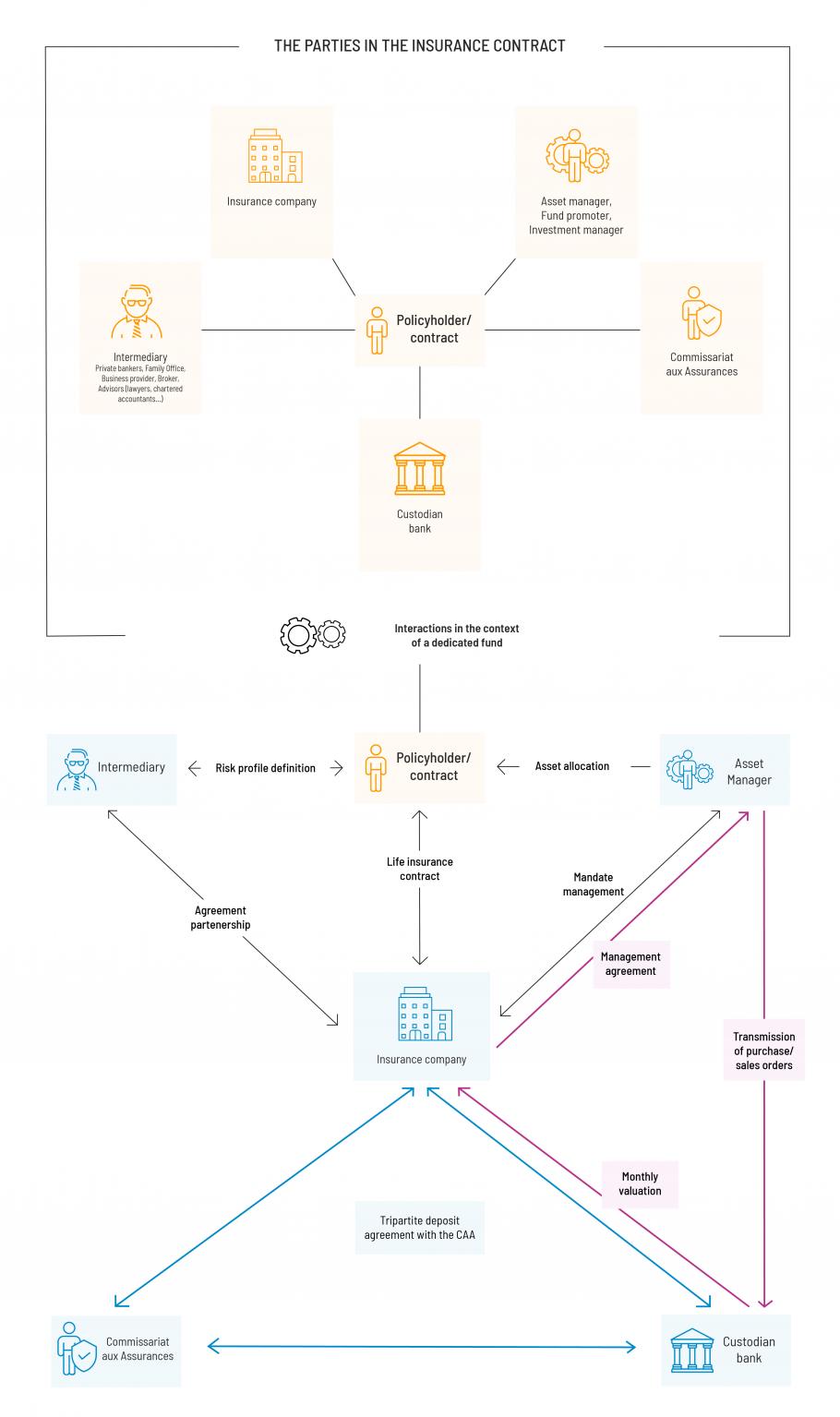

The parties in the insurance contract

By

Reading time: 3 min

Essential key players surround each life insurance contract concluded: the supervisory authority, the custodian bank(s), the asset manager(s) and the intermediary(s).

What are their interactions when setting up a dedicated internal fund?

Do you wish to have more information?

Contact us

The contents of this theme

The various players in a dedicated fund within a Luxembourg life insurance contract.

When a policyholder holds a dedicated fund in his Luxembourg unit-linked life insurance contract, different players are involved in managing the underlying of the life insurance contract: insurance company, custodian bank, asset managers and Commissariat aux Assurances.