Portability of the life insurance contract: what characteristics needs to be adapted when relocating?

Summary table

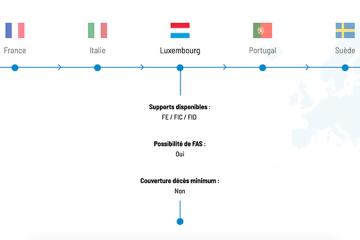

| Available investment | LPOA / SIF Possible | Minimum death coverage | |

|---|---|---|---|

| Belgium | FE / FIC / FID | No | No |

| Spain | FE / FIC / FID | No | Yes |

| France | FE / FIC / FID | Yes | No |

| Italy | FE / FIC / FID | Yes | |

| Luxembourg | FE / FIC / FID | Yes |

No |

| Portugal | FE / FIC / FID | Yes | No |

| Sweden | FE / FIC / FID | Yes | Yes |

Attention: in the context of a relocation, the policyholder should refer to his or her usual advisor or life insurance company beforehand, in order to analyse the situation in detail.

EF: External Funds

ICF: Internal Collective Fund

IDF: Internal Dedicated Fund

SIF: Specialized Insurance Fund

LPOA: Limited Power Of Attorney

When a policyholder holds a Luxembourg life insurance contract and choose to relocate, he can keep his policy, benefiting from its portability. However, some features of the contract (underlying assets, death coverage, etc.) will have to be adapted according to the choice of the country of destination.

Moreover, the taxation applicable to the contract will be that of the policyholder's country of residence and therefore the one of the country of destination.

Select the country of destination in order to find out which characterics are available.

In the context of an expatriation, one can maintain a Luxembourg life insurance contract and benefit from its portability. However, it is useful to carry out an audit before expatriation in order to find out whether certain features such as the underlying assets or the death cover need to be adapted.