Why choose Luxembourg?

EXPERT'S VOICE: QUESTIONS TO NICOLAS MACKEL

“If we look at the five-year horizon from 2020 to 2025, Luxembourg really sets its priorities in terms of developing further in: digitalization, sustainable finance and then of course talent attraction.”

Q1. WHAT ASSETS HAVE ENABLED THE GRAND DUCHY OF LUXEMBOURG TO BECOME THE CURRENT CENTRE OF FINANCIAL EXPERTISE?

Luxembourg has become over the last 30 years one of Europe’s leading financial centres and this has happened more or less on the back of several assets that Luxembourg has managed to put forward. The first one is its international makeup. I think if Luxembourg really brings an added value to Europe’s financial industry, it is the international expertise that whether, it's in the insurance business, in the fund business, in the banking business, you can find here in Luxembourg. This is also due to the international makeup of the population. We have nearly half of our population that is non-national, coming from as much as 174 different countries. And thus they bring with them not only linguistic skills, but also cultural understanding and knowledge of different markets. In addition to that I think that Luxembourg has really shown also now during the Covid crisis, at least here up to this point in the beginning that it has managed its public finances in a very very sound way. This stability translates into an economic situation that many countries envious and where Luxembourg is seen as a heaven of stability today. That for international investors is extremely important because that gives them a guarantee that five years, ten years and even twenty or more years down the road, their assets are safe. That is one of the main considerations. There are many other factors that have contributed to Luxembourg’s success, but I think these two: the international dimension and the economic stability of the country, really stand out as the two leading factors of it.

Q2. WHAT ROLE DOES LIFE INSURANCE PLAY IN LUXEMBOURG'S REPUTATION IN EUROPE?

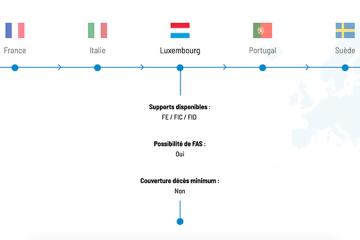

The life insurance sector in Luxembourg has grown over the last couple of years and become very important today in Luxembourg’s overall financial services landscape. Many large players from this area have come and set up operations in Luxembourg to sell their products to clients all over different European countries. It is part of Luxembourg’s overall wealth management offer and it is also one of the areas where Luxembourg can really show where it can offer an added value. The international expertise, the multi-jurisdictional expertise that Luxembourg is showing in the fund administration business, in the wealth management business, also obviously comes to good use in the life insurance sector. That is where Luxembourg over the last couple of years has been very successful in certain markets in particular: France, Italy, Spain and Scandinavia for instance; where Luxembourg products are seen as products that, in particular, offer a great stability, great security. That is what many of the subscribers to these products actually are looking for and are buying when they buy a Luxembourg product. It's the stability that the country is offering in particular in the area of life insurances, through what we here in Luxembourg call the “Triangle of Security”; which is a special arrangement, linking the regulator with the banks and the provider of the life insurance, to make sure the assets that the subscriber submits to the life insurance company will always be safe. That is first and foremost the proposal that Luxembourg can offer here and that has made Luxembourg one of the most successful jurisdictions for life insurances in Europe.

Q3. WHAT ARE THE CHALLENGES AND DEVELOPMENT PRIORITIES FOR LUXEMBOURG IN THE COMING YEARS?

The challenges that Luxembourg will face over the next couple of years are challenges that you will recognize many other jurisdictions are facing currently. First and foremost of course the consequences of the Covid crisis; where we don't know quite yet how this will continue to play out, on the health front as well as on the economic front. Then, there are other challenges. Luxembourg like many other jurisdictions has seen a very rapid growth. So talents, in numerical terms but also a qualitative growth, so talents in a qualitative sense have become scarce. This is something that definitely Luxembourg is aware of, that Luxembourg is addressing. The government has developed and is in the process of developing a national talent strategy, to address this issue. Other issues that Luxembourg is facing is for instance the levels of prices, the costs for real estate, the costs for employment. They can maybe be made up by other advantages that Luxembourg offers.

Overall if we look at the five-year horizon from 2020 to 2025, where Luxembourg really sets its priorities in terms of developing further, it is in areas such as digitalization, sustainable finance and then of course what I already spoke about namely talent attraction, the human side of things. In the area of digitalization, we have so far set up a good ecosystem to address this issue and help financial institutions operating in Luxembourg transition into the digital era. This will need to be deepened and this will need to continue in order to make sure that they have what is needed in order to continue to be leaders in their areas in Europe. Sustainable finance is, of course, also a transformational issue but it's even more of an existential issue. It is something that all of us will need to contribute to and so also of course, the insurance sector. We look at this in a very very serious way. We are very committed to this, and we would like too also by 2025, be one of the leaders in this area. Then of course, nothing happens without our talents, without the people that actually make a financial centre, that work in the industry. If the COVID crisis has taught us one thing, it is really that we need to put the human, our colleagues back into the centre of all our action.

Luxembourg benefits from genuine international expertise, whether in the field of insurance, funds management or banking. It is also a country that enjoys a true economic and political stability. The life insurance sector has become very important in recent years in the Luxembourg financial centre's range of services.