A world on the move: statistics on world and European mobility

Migration flows have become globalized since the beginning of the 21st century. There are now almost 272 million international migrants; i.e. people who were born in one country and live for a period generally exceeding one year in another country (definition of the United Nations Population Department).

An increasingly mobile world population

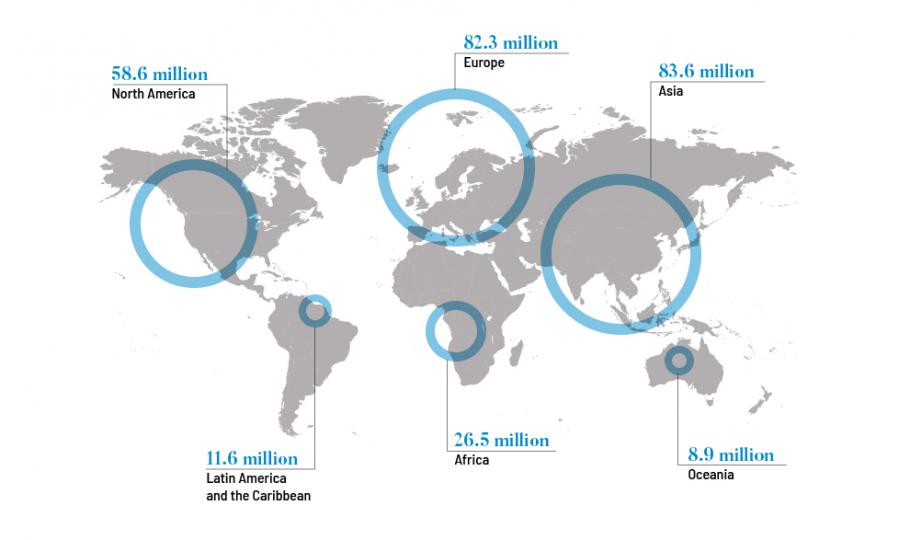

In 2019, the United Nations estimated the number of migrants in the world to be 272 million, which represents about 3.5% of the world's population. Of this population, nearly 71% move voluntarily in order to find work, better economic opportunities, reunite with a family, study... the reasons can often be multiple.

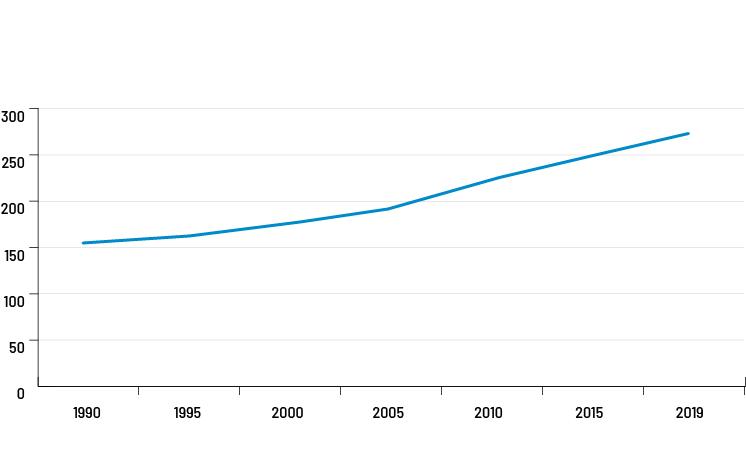

Evolution of the number of migrants since 1990 (in millions of people)

The number of migrants has been steadily increasing in recent years, with a growth of more than 23% compared to 2010.

International migrants at mid-2019

A European melting pot

Within Europe itself, out of the 512 million people who live there :

- - 7.8% million people do not have the nationality of the country where they live;

- - Luxembourg is the country with the highest proportion of people from another European Union Member State: 41% of the population, followed by Cyprus (13.3%) and Ireland (9%);

- - 1.3 million Europeans live in one country and work in another.

Today in Europe, people move more than ever before, whether for reasons related to education, work or tourism. And these movements have been greatly eased by all the agreements facilitating the free movement of goods and services.

What about relocation of High Net Worth Individuals?

There are nearly 14 million High Net Worth Individuals worldwide.

Of this population, nearly 108,000 millionaires emigrated in 2018, compared to 95,000 in 2017. The reasons why they relocate are fundamentally different. They are looking for better schools, financial security, quality of life and stable countries with financial systems that can protect their wealth.

World: Countries ranked by HNWIs net inflows, 20185

| Country | Net inflow of NHWIs in 2018 | % d'HNWIs gained ** |

| Australia |

12 000 |

3% |

|

United-States |

10 000 | 0% |

| Canada | 4 000 | 1% |

| Switzerland | 3 000 | 1% |

| United Arab Emirates | 2 000 | 2% |

| Caribbean* | 2 000 | 3% |

| New Zealand | 1 000 | 1% |

| Singapore | 1 000 | 0% |

| Israel | 1 000 | 1% |

| Portugal | 1 000 | 2% |

| Greece | 1 000 | 2% |

| Spain | 1 000 | 1% |

Notes: Figures rounded to nearest 1000.

*Caribbean includes Bermuda, Cayman Islands, Virgin Islands, St Barts, Antigua, St Kitts & Nevis etc.

**"% of HNWI gained" means the inflow divided by the total number of HNWIs living in that country.

The big losers in this better living competition are in Europe: France and the United Kingdom who both lost nearly 3,000 HNWI in 2018. They both suffer from rather high inheritance tax rates, without counting on Brexit in the case of the United Kingdom.

It is undeniable that, whatever the reasons, the world and European population is moving more than ever, and this trend is also noticeable among the wealthier populations. There is also a rush in government policies to attract these wealthy people with tax incentives and other golden visas.

It is becoming all the more necessary to plan ahead for relocation in order to ensure that the country chosen meets all the sought criteria in the long term.

1 https://www.un.org/en/global-issues/migration

2 Source: United Nations, Department of Economic and Social Affairs, Population Division (2019), International Migrant Stock 2019 (United Nations database, POP/DB/MIG/Stock/Rev2019). See : https://bit.ly/Migration2019

3 Source : https://ec.europa.eu/eurostat/cache/digpub/eumove/index.html?lang=en, data from 2018

4 Person holding financial assets (excluding their primary residence) with a value greater than US$1 million.

5 Source: New World Wealth : https://newworldwealth.com/

There are around 14 million High Net Worth Individuals worldwide. Out of this population, almost 108,000 millionaires moved in 2018. In the event of a change of residence, the Luxembourg life insurance policy can follow the policyholder in his or her change by making adjustments if necessary in terms of contract's structure and underlying assets.