A winning team: the Luxembourg RAIF and its AIFM

What makes the RAIF unique?

The key difference to fully regulated structures is that a RAIF does not have to be approved by the regulator before it can start doing business. RAIFs are established by notarial certification. As a result, it takes less time to launch the investment product, and fund initiators save regulatory fees upon creation and in case the fund documents have to be amended.

Contrary to normal company structures RAIFs can be set up in the form of an umbrella fund with multiple compartments and share/unit classes. As such, they can invest in any type of assets, which makes them attractive for different types of investors and managers pursuing multiple investment strategies. However, if the RAIF’s constitutional documents provide for exclusive investments in risk capital, the principle of risk spreading does not apply and it is subject to the SICAR’s tax regime. This concept is particularly popular in the private equity and venture capital sphere.

Protection of investors

One might be tempted to say that more flexibility and a shorter time to market goes to the detriment of investor protection. But the legislator introduced safeguards to avoid exactly this.

In terms of management, the law provides that a RAIF must be managed by a fully authorised external Alternative Investment Fund Manager (AIFM). The latter’s role is enhanced by the fact that it is up to the AIFM to ensure that the fund complies with the applicable rules. As usual, the AIFM is required to regularly report about its business to the regulator, including regarding the management of its RAIFs.

Moreover, RAIFs are “reserved” to well-informed investors. This includes professional and institutional investors like insurance companies and pension funds, and any other investors who meet the following conditions:

- investors confirm in writing that they adhere to the status of well-informed investor, and

- they invest a minimum of 125,000 Euro in the RAIF, or they have an appraisal from a credit institution, by an investment firm or by a management company certifying their expertise, experience and knowledge in adequately apprising an investment in the RAIF.

It is also important to note that the RAIF’s major services providers (depositaries, lawyers, auditors, etc.) are all regulated entities.

Distributing across the EU

Thanks to its AIFM the RAIF can be distributed to investors in the EU/European Economic Area following simple regulatory notification, usually within 20 working days. This means that, just as for any other funds that are managed by an authorised AIFM, marketing in the different Member States is not subject to separate authorisations.

A success story

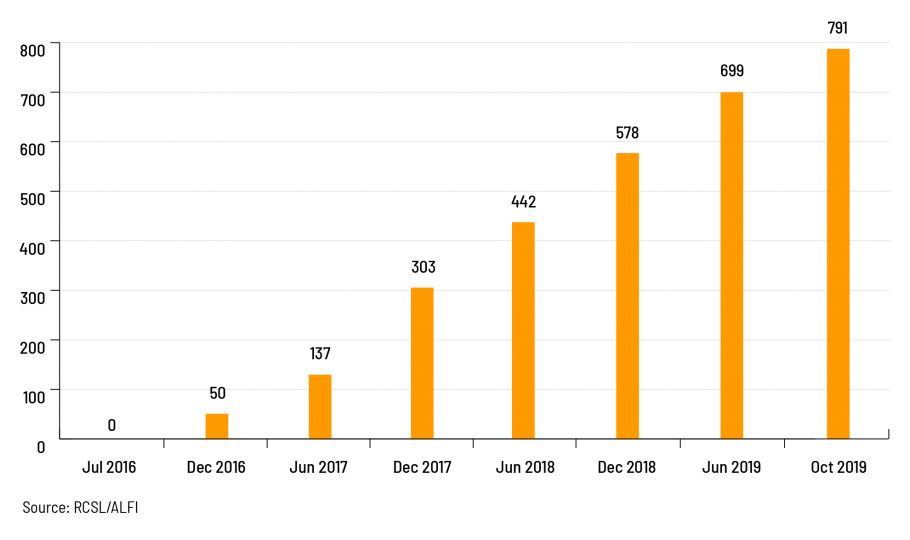

All these features have contributed to the RAIFs and its AIFM’s success story. Since July 2016 almost 800 RAIFs have been set up. The steady growth does not mean that other Luxembourg investment vehicles like the Specialised Investment Fund (SIF) or investment company in risk capital (SICAR) become redundant. There is simply more choice for any kind of investment needs.

Number of RAIF: evolution since inception in July 2016

The RAIF is a reserved alternative investment fund created in 2016. It is possible to insert a RAIF in a Luxembourg life insurance contract. The RAIF is reserved to a well-informed investor who can invest a minimum of EUR 125,000. The FIAR is accessible to policyholders in the European Union.